Investment Thesis

Home Depot (NYSE:HD) is the world’s largest home improvement retailer based on revenue. They have over 2,000 stores located across North America. With rising home prices, homeowners are motivated to remodel their homes, which in turn pushes up house prices even further. Home Depot has been riding this uptrend for a while, and I expect that to be the case for the foreseeable future. I believe Home Depot presents an excellent investment opportunity for a long term investor because:

- Their revenue has been rising steadily over the past couple of decades, and the trend will continue for the foreseeable future.

- Their brand recognition, network size, and customer and vendor relationships create an economic moat, and it will be sustained for a while.

- Cash generating ability is outstanding, and they have been rewarding shareholders with dividends and buybacks. I expect this to be the case for the foreseeable future.

Home Prices Rise, and So Does Home Depot Revenue

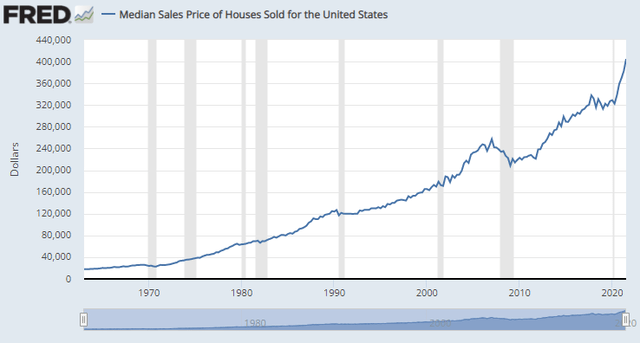

The price of U.S. homes has been rising over the past four decades. It is kind of a self-reinforcing mechanism. As the house price rises, the homeowners recognize that owning and renovating their home is a great investment. The renovation pushes the home price up even further. I don’t think this trend will abate anytime soon. The most recent housing data shows that the U.S. home prices surged 18.4% in October, which was slightly lower than their September figure of 19.1%. The forty year trend of median sales price is shown below.

Source: FRED

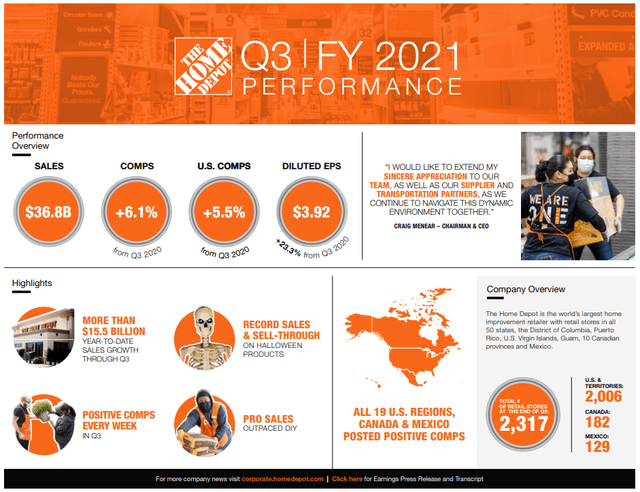

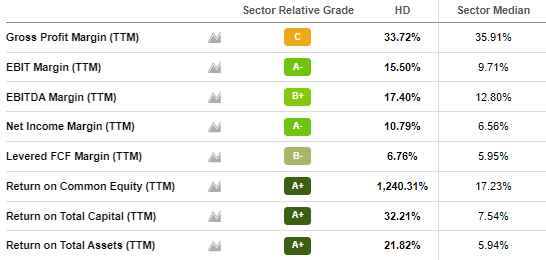

Home Depot is in a perfect spot to take advantage in this upward trend. Riding these trends, Home Depot’s revenue has risen steadily (9.12%, 5 year average growth) over the decades. Regardless of whether the project is DIY or a pro contractor, Home Depot provides the bulk of the materials for the renovation. They had solid performance last quarter (shown below), and the Home Depot executives and analysts expect the solid demand to continue. The summary of 3Q performance and revenue trend are shown below.

Source: Infographic from investor relations

Economic Moat and High Profitability

Home Depot has key competitive advantages. These are: 1) their culture and associates, 2) their premium real estate, 3) their world-class merchandising organization, 4) a flexible supply chain, and 5) their digital platform. These five pillars create an economic moat for Home Depot, and their effects are demonstrated through their profitability metrics.

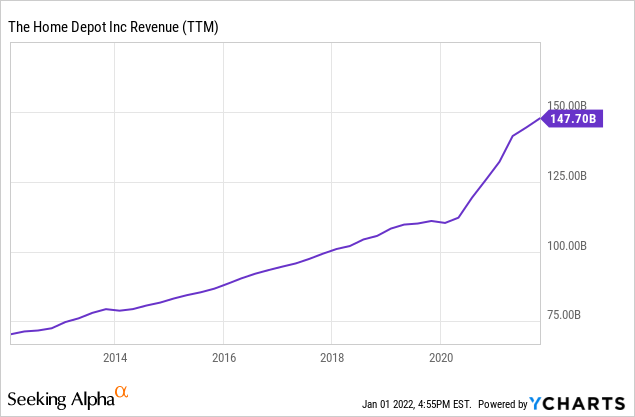

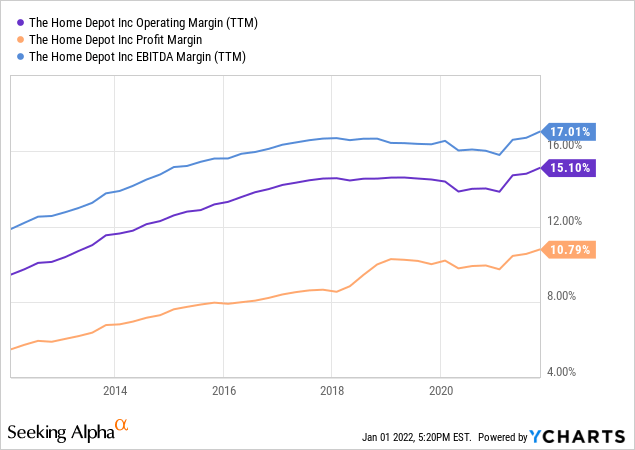

Their EBIT margin (15.50%), EBITDA margin (17.40%), and net income margin (10.79%) are well above the sector medians. Also, their return on total capital (32.21%) and return on assets (21.82%) are outstanding. These metrics shows how efficiently Home Depot’s management uses capital. Even with the ongoing supply chain issue, they are doing an exceptional job at maintaining the margins. Their operating margin, EBITDA margin, and profit margin are in line or better than per-pandemic times.

Source: Seeking Alpha

Source: YCharts

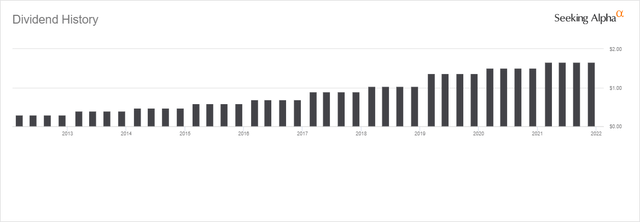

Cash from Operation and Rewards for Shareholders

Thanks to their economic moat and increasing revenue, they have been generating a boat load of cash. The cash from operations increased from $6.6 B in 2012 to $14.8 B in 2021. This upward trend won’t stop anytime soon. Utilizing this pile of cash, Home Depot has been rewarding shareholders nicely through dividend and share buybacks. They repurchased over $10 B of their common stock in the last 12 months, and they have been steadily increasing their dividend over the past 12 years. I believe this trend will continue for the foreseeable future. Their dividend payment history is shown below.

Source: Seeking Alpha

Intrinsic Value Estimation

I utilized DCF model to estimate the intrinsic value of Home Depot. For the estimation, I utilized the EBITDA ($25,694M) as cash proxy and current WACC of 6.5% as the discount rate. For the base case, I assumed EBITDA growth of 10% (consensus revenue growth rate from Seeking Alpha) for the next 5 years and zero growth afterwards (zero terminal growth). For the bullish and very bullish case, I assumed EBITDA growth of 13% and 15%, respectively, for the next 5 years and zero growth afterwards.

The estimation showed that the current stock price represents 15-20% upside from the current level. Given the positive outlook on housing market and Home Depot’s leadership position, I expect Home Depot to achieve this upside easily in the future.

| Price Target | Upside | |

| Base Case | $428.93 | 3% |

| Bullish Case | $482.68 | 16% |

| Very Bullish Case | $521.67 | 28% |

The assumptions and data used for the price target estimation are summarized below:

- WACC: 6.5%

- EBITDA Growth Rate: 10% (Base Case), 13% (Bullish Case), 15% (Very Bullish Case)

- Current EBITDA: $25,694 M

- Current Stock Price: $415.01 (12/30/2021)

- Tax rate: 30%

Risk

Recently the Federal Reserves announced that they will be tapering the ultra-easy monetary policy and start to increase interest rates faster than previously planned. The change in this tapering plan (even though it was expected) has been creating volatility in the market, and the volatility may last for some time. Home Depot stock price won’t be immune. Also, rising interest rates typically have a negative impact on the housing price because mortgage rates rise with the Federal interest rate. This may suppress Home Depot’s growth trajectory.

However, the volatility created by the interest rate hike will be short term, and won’t have an impact on Home Depot’s long term growth prospects. Also, if the interest rate hike effectively tempers inflation, it will have a positive impact on the economy in general, which will in turn positively impact Home Depot’s growth in the long run.

Conclusions

Home Depot is one of those stocks that you know will do well and anchor your portfolio over the long term. Their revenue will continue to rise as long as house prices rise. Also, their supply network, brand recognition, and customer relations create an economic moat that won’t be breached by any competitor anytime soon. Thanks to their strong cash generating ability, they should be able to continue to reward shareholders with increasing dividend and stock repurchases. While market volatility and increasing interest rates may challenge Home Depot in the short term, it won’t have a lasting impact on their long term growth trajectory. I expect 15-20% upside from the current level.