- The development of COVID-19 vaccines has buoyed the fortunes of several pharma and biotech companies this year.

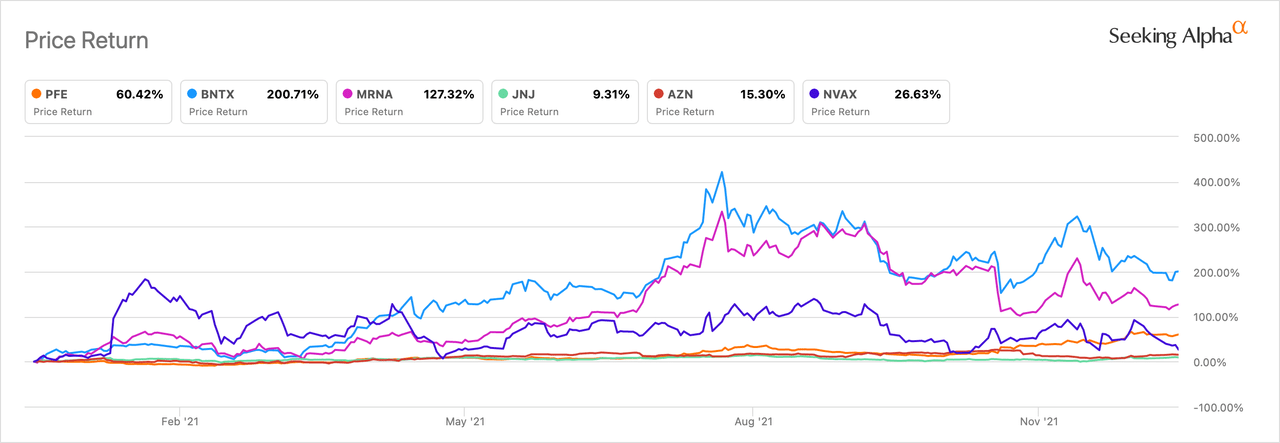

- Pfizer (NYSE:PFE), BioNTech (NASDAQ:BNTX), Moderna (NASDAQ:MRNA), and Novavax (NASDAQ:NVAX) have all had stellar returns this year.

- Johnson & Johnson (NYSE:JNJ) and AstraZeneca’s (NASDAQ:AZN) returns were more modest.

- A big question on many investors’ minds is whether these impressive returns will continue in 2022. It depends.

- A big question mark is whether the demand for COVID shots will continue at its current pace and/or whether COVID vaccines will be needed every year much in the way flu shots are given. Boosters helped sustain demand through the end of 2021, though it is unclear whether additional boosters will be required in the future, and if so, how often they will be administerd.

- If future variants are like Omicron — easily transmissible but causing less severe disease — COVID will soon end up as an endemic disease. The easy spread of Omicron may also help countries achieve herd immunity.

- Another question is whether countries will push back on vaccine prices, and what kind of leverage they might have. An analysis from Pharmaceutical Technology found that vaccine prices vary wildly around the world. For example, Moderna’s vaccine costs the U.S. government around $15 per shot, while in the EU, it is about $22.50 based on one deal.

- Although Novavax gained ~27% in 2021, the company still faces an uphill battle. Its COVID vaccine has only been authorized in a handful of countries and by the WHO.

- On Friday, the company finally submitted a data package to the FDA for the vaccine, but an Emergency Use Authorization won’t be filed until sometime this month.

- Even if it wins approval in the U.S., its uptake is far from certain given how popular the Pfizer/BioNTech and Moderna shots are. Novavax’s vaccine will likely play a larger role in poorer countries due to easier requirements for transport and storage.

- Moderna’s vaccine is the first approval ever for the company. The company has two mid-to-late mRNA vaccine candidates: mRNA-1010 for flu and mRNA-1345 for respiratory syncytial virus. The latter will enroll 34K participants in a phase 2/3 trial.

- Moderna shares traded down after presenting interim results from a phase 1 trial of mRNA-1010 in December.

- If Moderna’s stellar returns are to continue past 2022, it will likely need approval of one of these two candidates.

- Johnson & Johnson and AstraZeneca are in pretty much the same boat. As large pharmaceutical companies, their COVID vaccines didn’t account for as much as their bottom lines as other companies. Both have many other drugs that account for larger revenue streams, not to mention healthy pipelines which should allow for continued modest returns next year.

- BioNTech was a German biotech relatively few people knew about a couple of years ago but the COVID vaccine changed that. Although the stock’s high for the year peaked in August and has come down moderately since then, it is well positioned for continued growth.

- A combination of likely continued strong revenue from its COVID vaccine and its strong pipeline — especially two mRNA cancer immunotherapies — bode well for BioNTech in 2022.

- Perhaps the best positioned of the bunch is Pfizer because of orders for its COVID antiviral treatment Paxlovid, and its robust pipeline.

- Pfizer should also continue to enjoy handsome profits from its two best-selling drugs, the vaccine Prevnar 13 and the oncologic Ibrance (palbociclib), which has 2020 sales of, respectively, ~$5.9B and ~$5.4B. The company shared ~$14.1B 2020 revenue from Eliquis (apixaban) with partner Bristol-Myers Squibb.

- Pfizer’s late-stage pipeline is particularly strong in rare diseases. The company has six new molecular entity candidates in phase 3, all with Orphan Drug and/or Fast Track status.