Today we are highlighting a fast growing fintech. The chart looks solid ahead of earnings next week. The stock trades with some beta, but the alpha opportunity looks solid here. We are most impressed with the trends in the key metrics. While we often analyze regional banks for signs of economic strength, this one hit our pitch list last week and we are looking to builld a position. Provided the outlook is in line, or better, than expectations, this stock remains at a relative discount overall, with the potential to double over the next 18 months if metrics continue to improve. The name in question is Inter & Co (INTR).

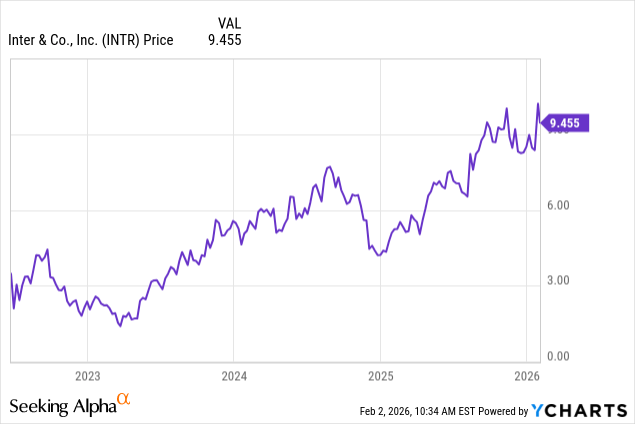

A solid run indeed for the stock in 2025, but given the trends in operations, there is little resistance for this stock to continue higher. While some bumps in the road from market weakness, but we plan to take advantage so long as the earnings story holds up.

The suggested play

Target entry 1: $9.10-$9.20 (30% of position)

Target entry 2: $8.50-$8.70 (33% of position)

Target entry 3: $7.75-$7.95 (37% of position)

Target exits: $11 if one leg, $10.50 if 2 legs, $9.90 if 3 legs

Suggested stop: $7.00

Options here are a bit thin, but a buy-write can work, buying commons and selling the $10 April 2026 call strike for about $0.60, or, selling the April 2026 $7.50 Put for $0.25 credit can work

Discussion

Inter & Co Inc. is a prominent fintech company that operates primarily through its subsidiary, Banco Inter. Originally established in Brazil as a traditional financial institution in the 1990s, the company underwent a radical transformation in 2015 to become the first fully digital bank in Brazil. Now I want to be clear, it is way beyond Brazil now. Today, it functions as a comprehensive super app, serving over forty million customers across the Americas. By consolidating a wide array of financial and lifestyle services into a single digital ecosystem, Inter & Co aims to simplify the lives of its users, offering everything from basic checking accounts to complex investment tools and a retail marketplace.

The core of Inter & Co’s business model is built around its digital banking platform, which provides a suite of services designed to capture a significant share of a customer’s daily transactions. Its operations are divided into several key segments, including banking, investments, insurance brokerage, and a marketplace known as Inter Shop. The banking segment is the largest, offering fee-free checking accounts, credit and debit cards, and various lending products such as mortgages and payroll-linked loans. By providing these services digitally, the company maintains a much lower cost structure than traditional brick-and-mortar banks, allowing it to offer competitive rates and scale rapidly without the overhead of physical branches. Some have called it similar to an international Sofi in some of our circles. How so?

To generate revenue, Inter & Co utilizes a diversified strategy that balances interest-based income with fee-based services. A significant portion of its earnings comes from net interest income, which is the difference between the interest it earns on loans and the interest it pays out on deposits. Because the company attracts a large volume of low-cost deposits through its popular digital accounts, it can maintain healthy margins on its credit products. Additionally, the company earns substantial revenue from securities transactions and interchange fees every time a customer uses an Inter-branded card for a purchase. This dual focus on lending and transactional volume provides a stable financial foundation even in fluctuating economic environments.

Beyond traditional banking, the company has successfully monetized its super app ecosystem through commissions and service fees. Its investment segment, Inter Investments, allows users to trade stocks and manage assets, generating revenue through brokerage fees and administration charges. Similarly, the insurance brokerage arm partners with various insurance providers to offer life, property, and auto insurance directly through the app, earning commissions on every policy sold. This ecosystem approach is further enhanced by the Inter Shop marketplace, where the company facilitates retail sales between third-party vendors and its massive user base, taking a percentage of each transaction as a referral or platform fee.

In recent years, Inter & Co has aggressively expanded its footprint into the United States, positioning itself as a cross-border financial partner for the global community. Through its Global Account, it offers international remittances to over sixty countries, dollar-denominated accounts, and specialized services for Brazilian expatriates and businesses operating in the U.S. market.

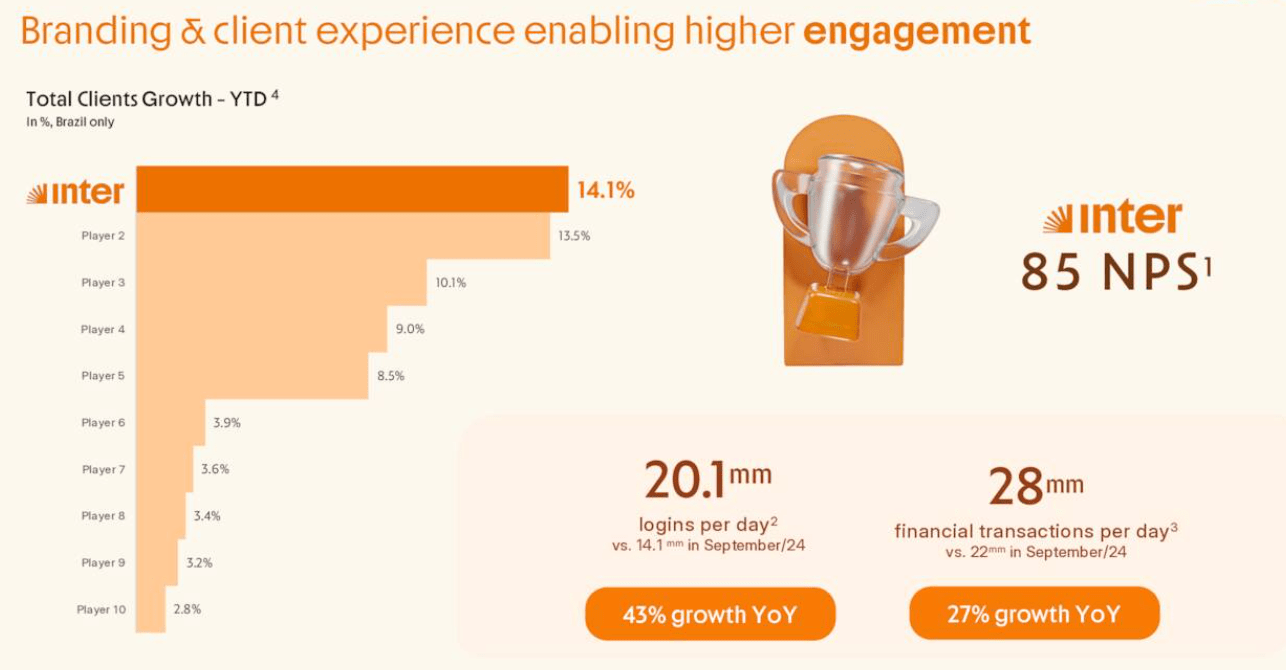

This international expansion is supported by strategic partnerships and high-profile marketing, such as the naming rights for Inter & Co Stadium in Orlando. By bridging the gap between Latin American and North American financial systems, the company is diversifying its geographic risk and tapping into new, high-growth revenue streams. The market share gains have been impressive.

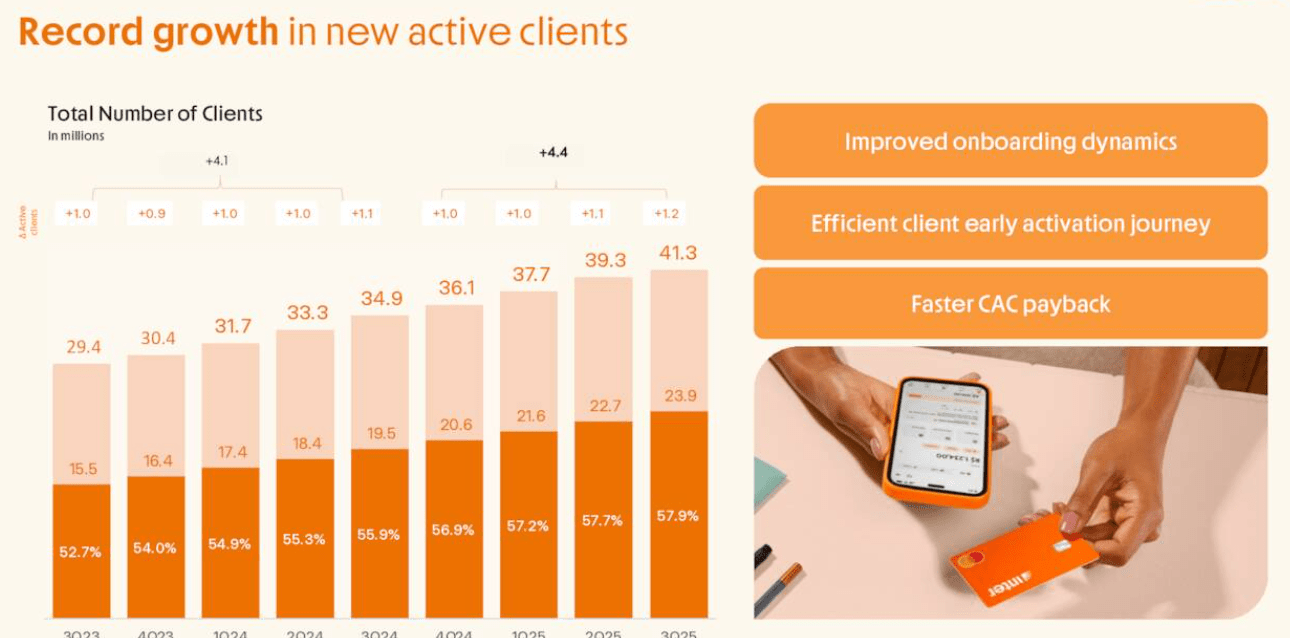

Why are we excited about a position in this one for the medium term? Well, looking forward, Inter & Co is executing a long-term strategic plan often referred to as the 60-30-30 goal, which targets reaching sixty million clients, a 30% efficiency ratio, and a 30% return on equity. To achieve this, the company is focusing on increasing customer engagement and the “activation rate” of its users, encouraging them to use Inter as their primary bank for all financial needs. By leveraging data-driven insights to refine its credit underwriting and expanding its high-margin products like private payroll loans, Inter & Co is striving to transform its rapid user growth into durable, long-term profitability within the competitive global fintech landscape. How about recent performance?

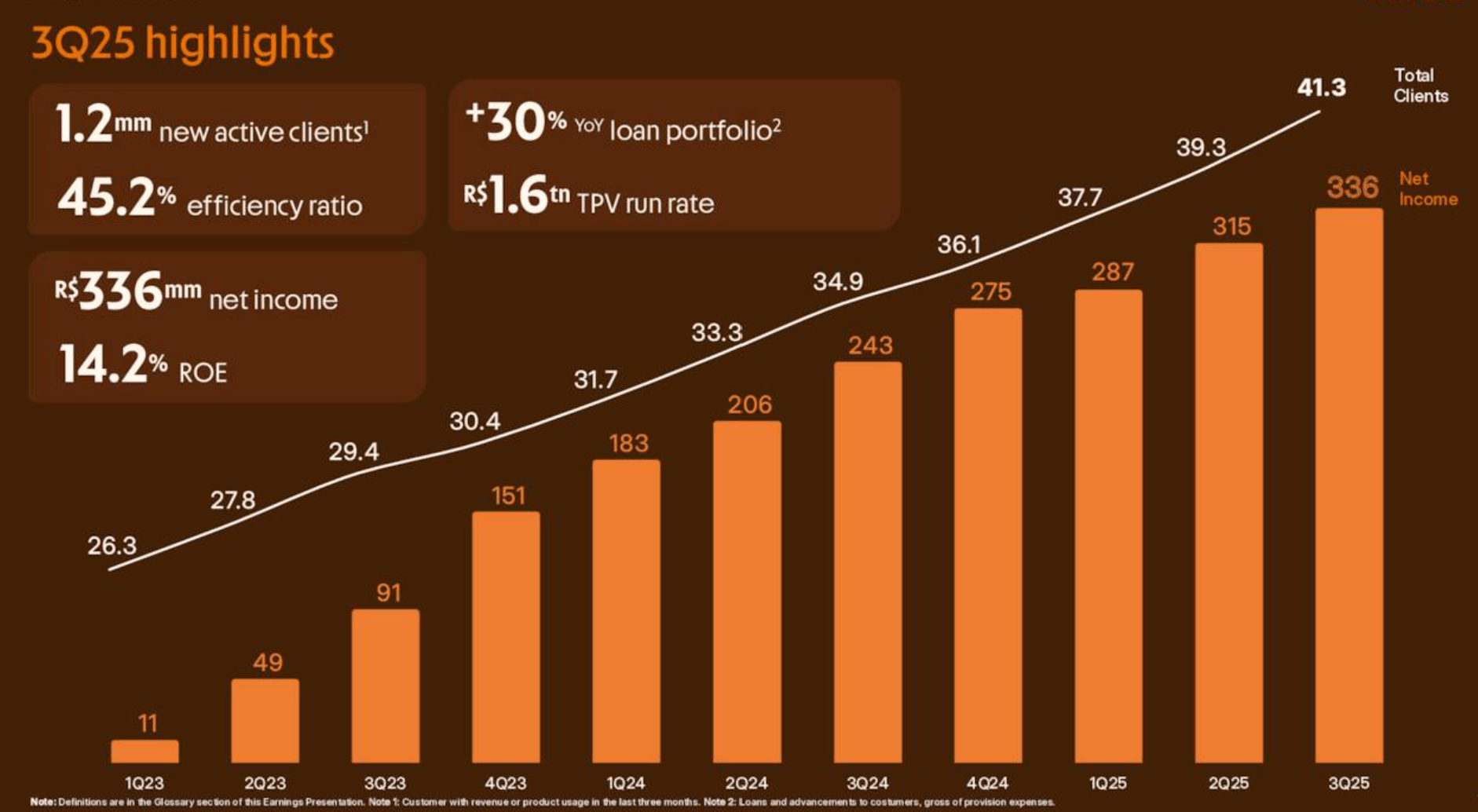

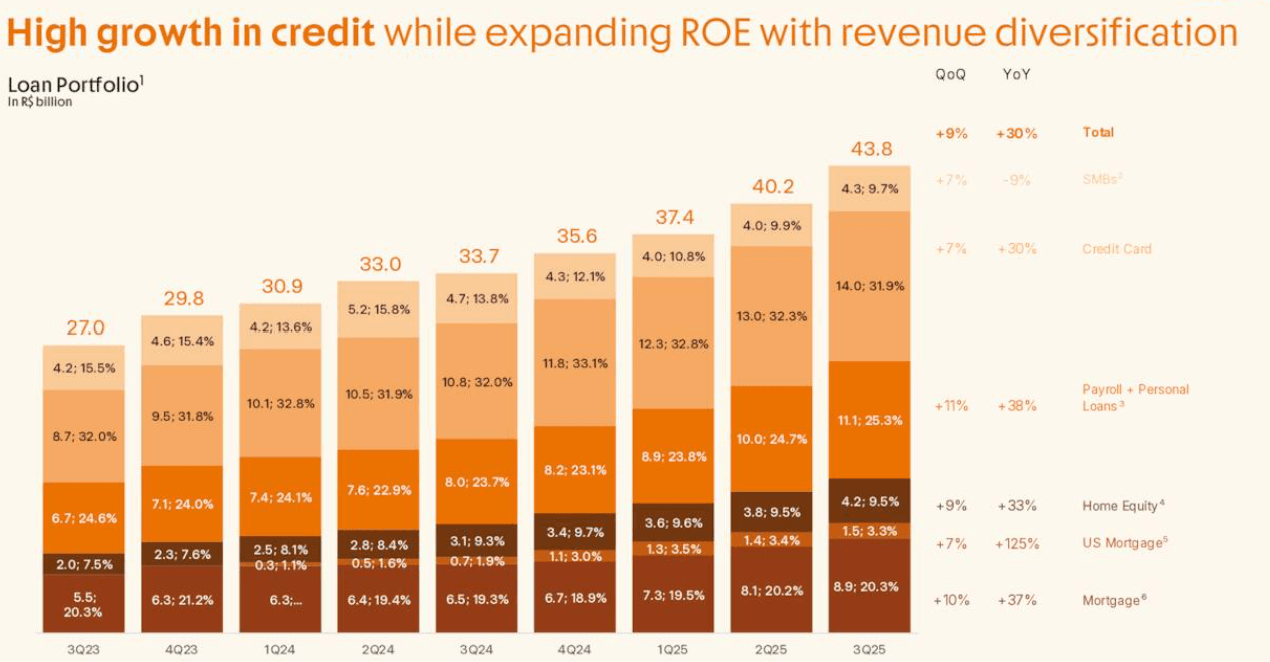

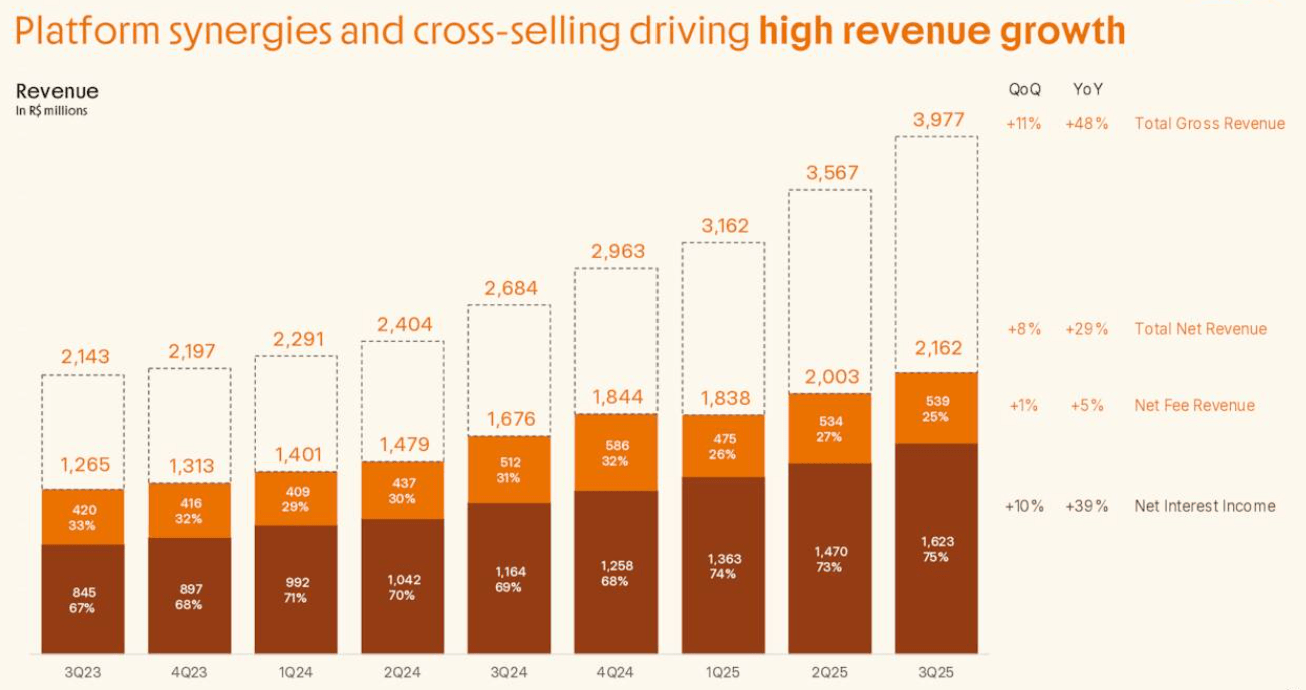

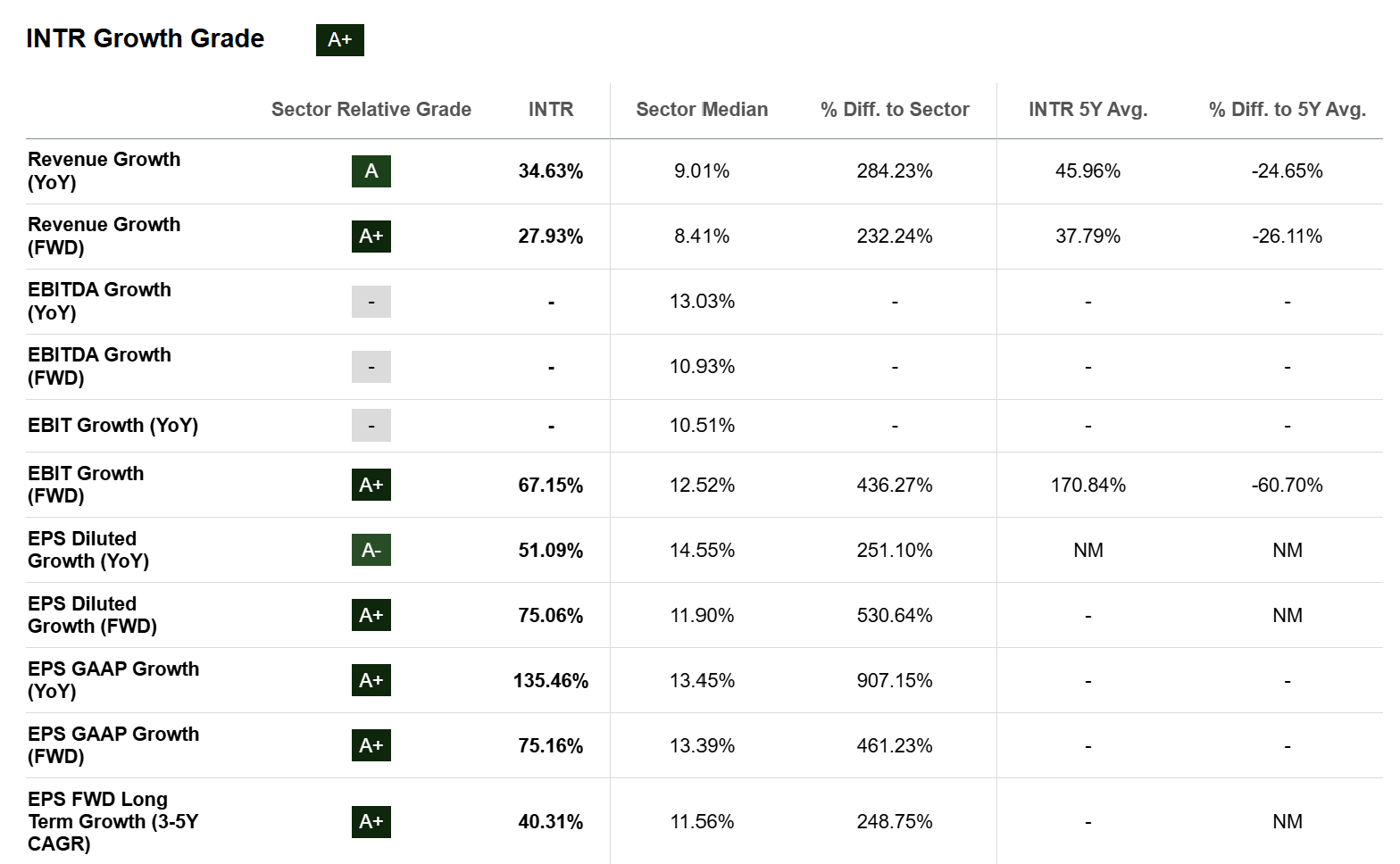

In the third quarter of 2025, Inter & Co reported record-breaking financial results characterized by a significant expansion in both its top and bottom lines. Net revenue reached BRL 2.1 billion, representing a 29% increase compared to the same period in the previous year and an 8% sequential growth from the second quarter. This revenue surge was primarily propelled by the credit vertical, where net interest income jumped 39% year-over-year. The company also achieved a milestone in profitability, posting a record net income of BRL 336 million, which reflects a 39% increase from the prior year and demonstrates the company’s ability to scale its earnings alongside its user base. The company is seeing very high growth in credit with revenue diversification.

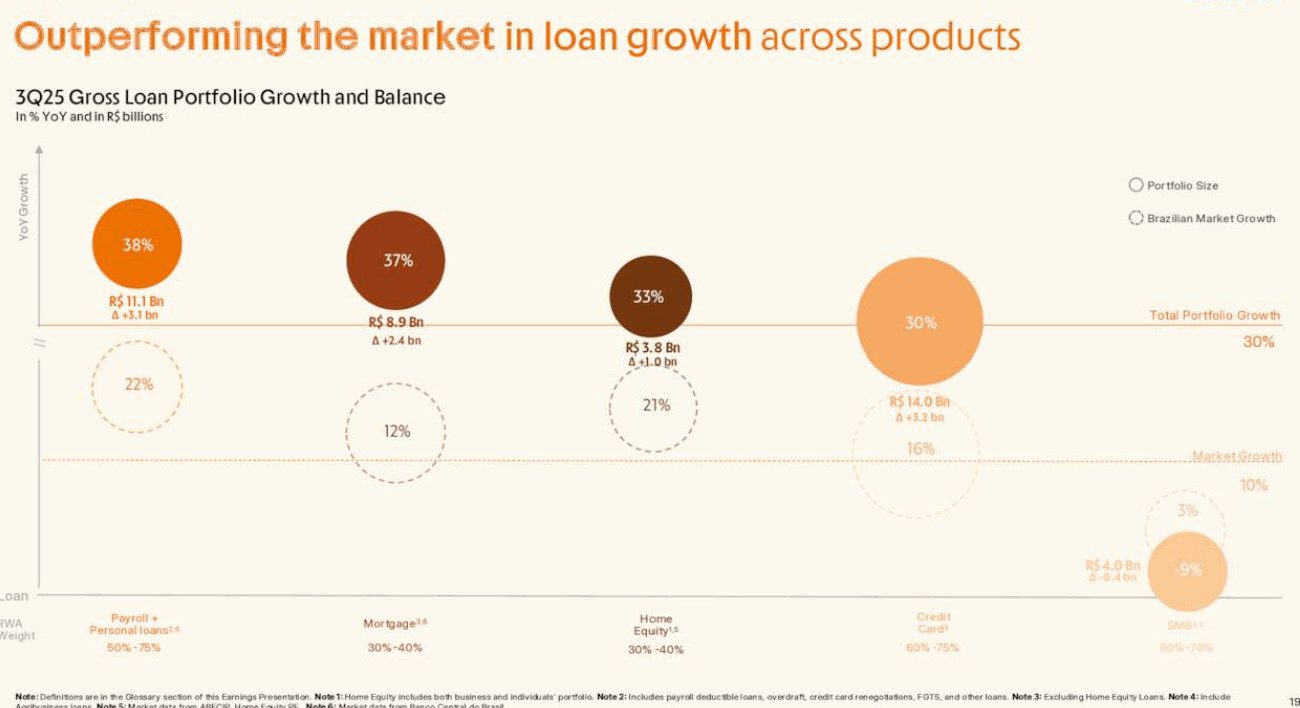

The lending operations saw substantial momentum, with the total loan book growing 30% year-over-year to reach BRL 43.8 billion. On an annualized basis, the quarterly growth accelerated to 36%, driven largely by collateralized products and the successful launch of private payroll loans. This specific payroll portfolio grew to BRL 1.3 billion within just six months of its introduction, serving over 300,000 clients. Additionally, the mortgage portfolio expanded by 37% to reach BRL 9 billion, while credit card volumes surpassed the BRL 15 billion mark for the first time, marking a 20% annual increase in total processing volume.

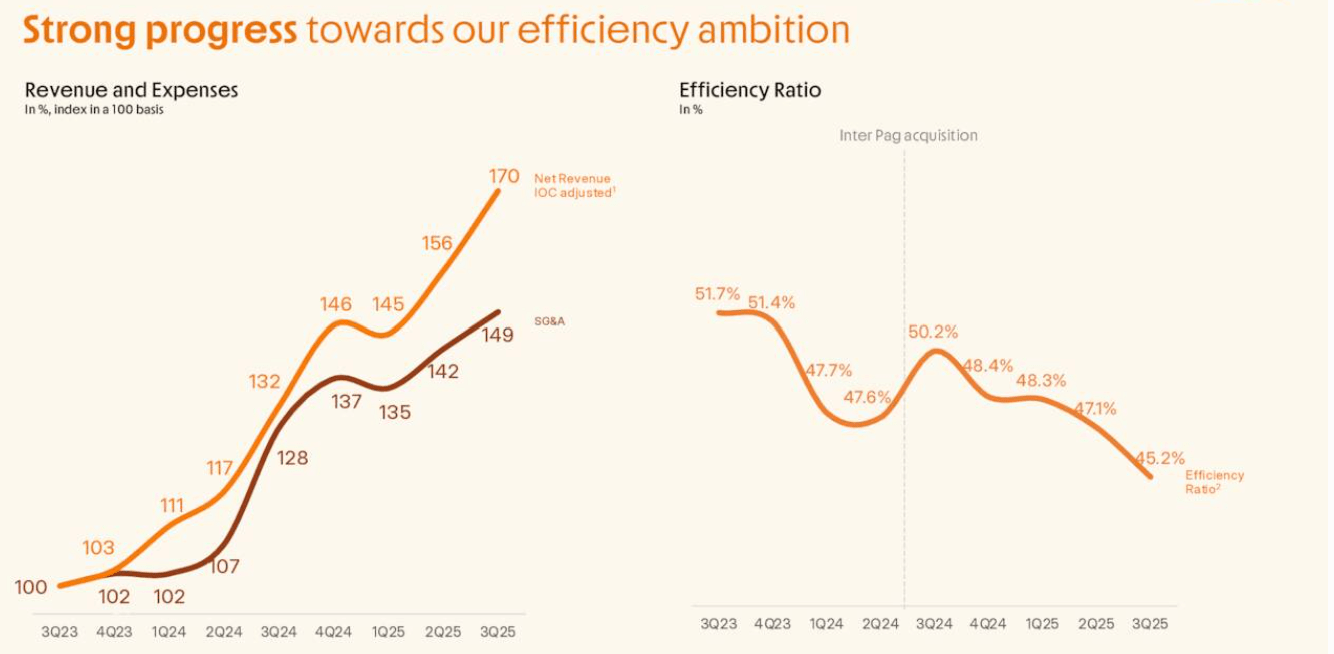

Efficiency and profitability ratios showed marked improvement, moving the company closer to its long-term strategic targets. The efficiency ratio improved by 190 basis points during the quarter, dropping from 47.1% to 45.2%, as total expense growth was limited to 16% year-over-year, roughly half the pace of revenue growth. This operational leverage contributed to a return on equity of 14.2%, up from 13.9% in the previous quarter. These metrics indicate that the digital banking model is successfully converting high transaction volumes and client engagement into sustainable profit margins.

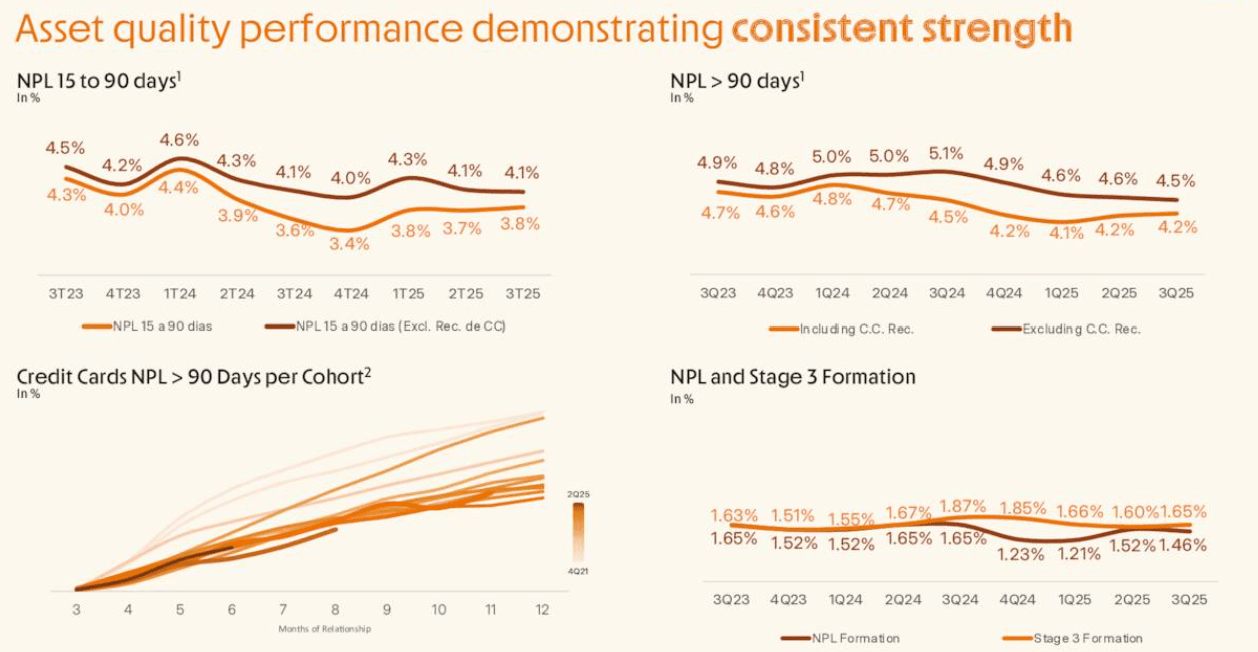

Asset quality remained resilient despite the aggressive expansion of the credit portfolio. The 90-day non-performing loan ratio improved slightly, decreasing by 10 basis points to 4.5%, while the 15-to-90-day delinquency rate held steady at 4.1%. The cost of risk was reported at 5.35%, an increase largely attributed to the upfront provisioning required for the rapidly growing private payroll portfolio. However, management noted that the return profile of this new portfolio has already passed its break-even point and is expected to contribute high levels of profitability in future quarters.

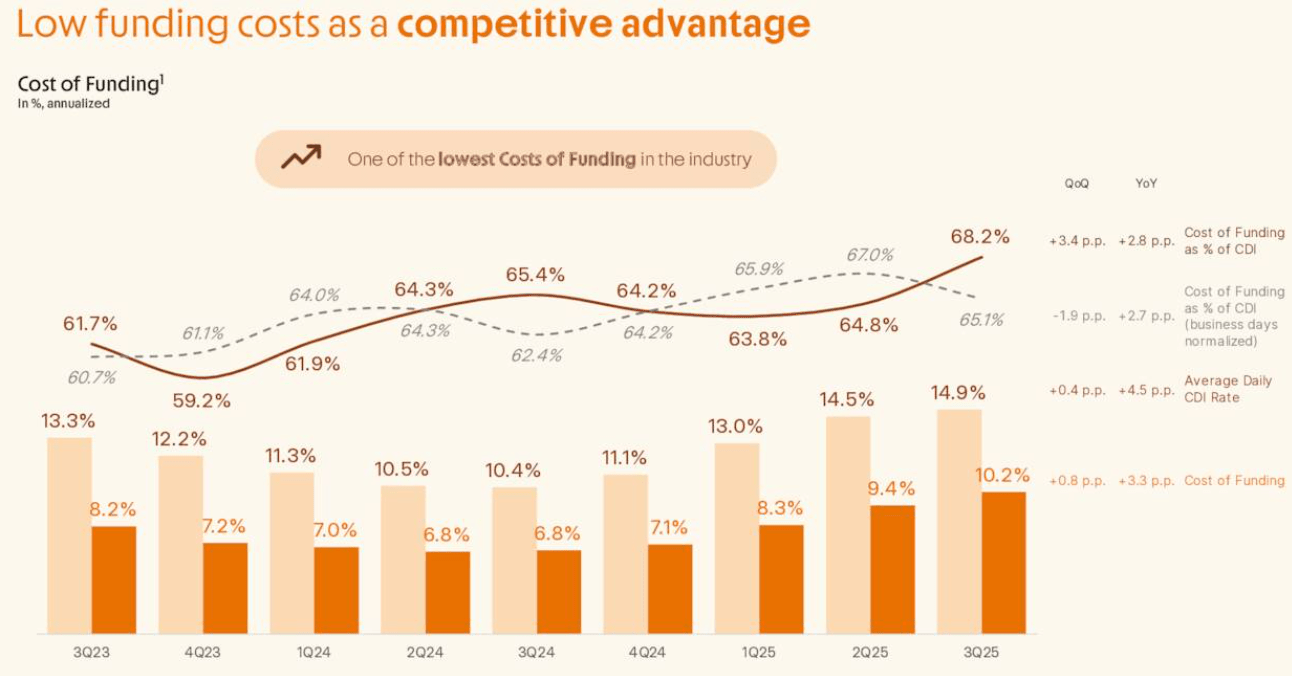

The company’s funding franchise continued to provide a competitive advantage through low-cost deposits and strong liquidity. Total funding reached BRL 68 billion, a 35% increase year-over-year, led primarily by time deposits and transactional balances. The cost of funding was maintained at a highly efficient 68.2% of the Interbank Deposit Rate (CDI), or 55.1% when adjusted for business days. Notably, the average deposit per active client surpassed BRL 2,000 for the first time, signaling deeper trust and primary bank status among its 24 million active users.

Monetization metrics also trended upward, with the net average revenue per active client rising to BRL 33.2. While the overall average reflects a mix of new and old users, mature customer cohorts are already generating nearly BRL 90 in revenue. When weighed against a low cost to serve of BRL 13.1, the resulting gross margin per active client reached a record BRL 20.2. This increasing spread between revenue and service costs highlights the effectiveness of the cross-selling strategy across the company’s seven business verticals.

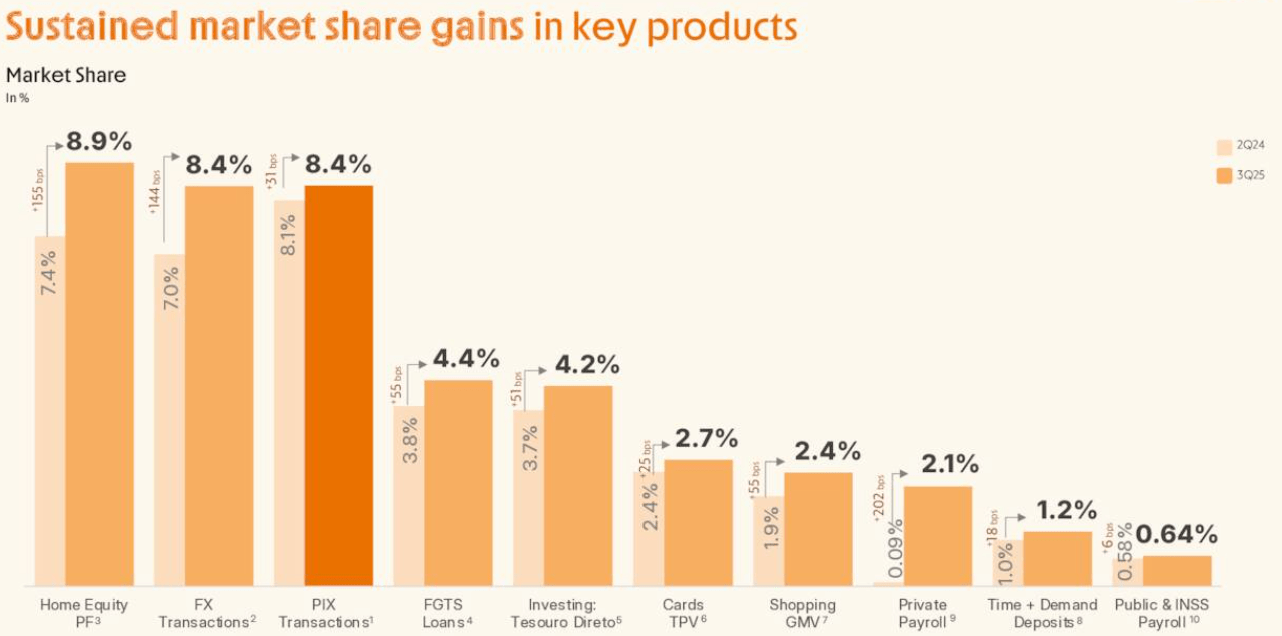

Market share gains in specialized products further diversified the revenue mix away from standard interest income. Inter & Co now holds an 8.9% market share in home equity portfolio balances for individuals, making it the second-largest underwriter of this product in Brazil. In the foreign exchange sector, driven by its Global Account offering, the company captured 8.4% of market transactions. These gains in high-margin niches, combined with a 30% growth in transaction volumes to BRL 412 billion, underscore the broad-based financial strength of the ecosystem as of late 2025. The company is making real progress toward 30% efficiency (which would rank it among the top 2-3% all time of financials we cover).

Finally, the capital structure remained robust, with a Basel ratio of 14.6%, ensuring the bank is well-capitalized to support future growth. The assets-to-equity ratio increased from 7.9x to 9.4x year-over-year, reflecting a more efficient use of the company’s capital base. By maintaining high liquidity and stable asset quality while simultaneously improving its efficiency and ROE, the company has positioned itself to continue its trajectory toward its 60-30-30 goal of sixty million clients and 30% returns.

The operations are incredible here and we have no reason to believe that metrics will fall off with the coming report. It will come down to a strong guide, but by all accounts management has been delivering. As an aside, analysts on the last conference call noted the incredible strength. Fundamentally, the value and growth combination is of course notable.

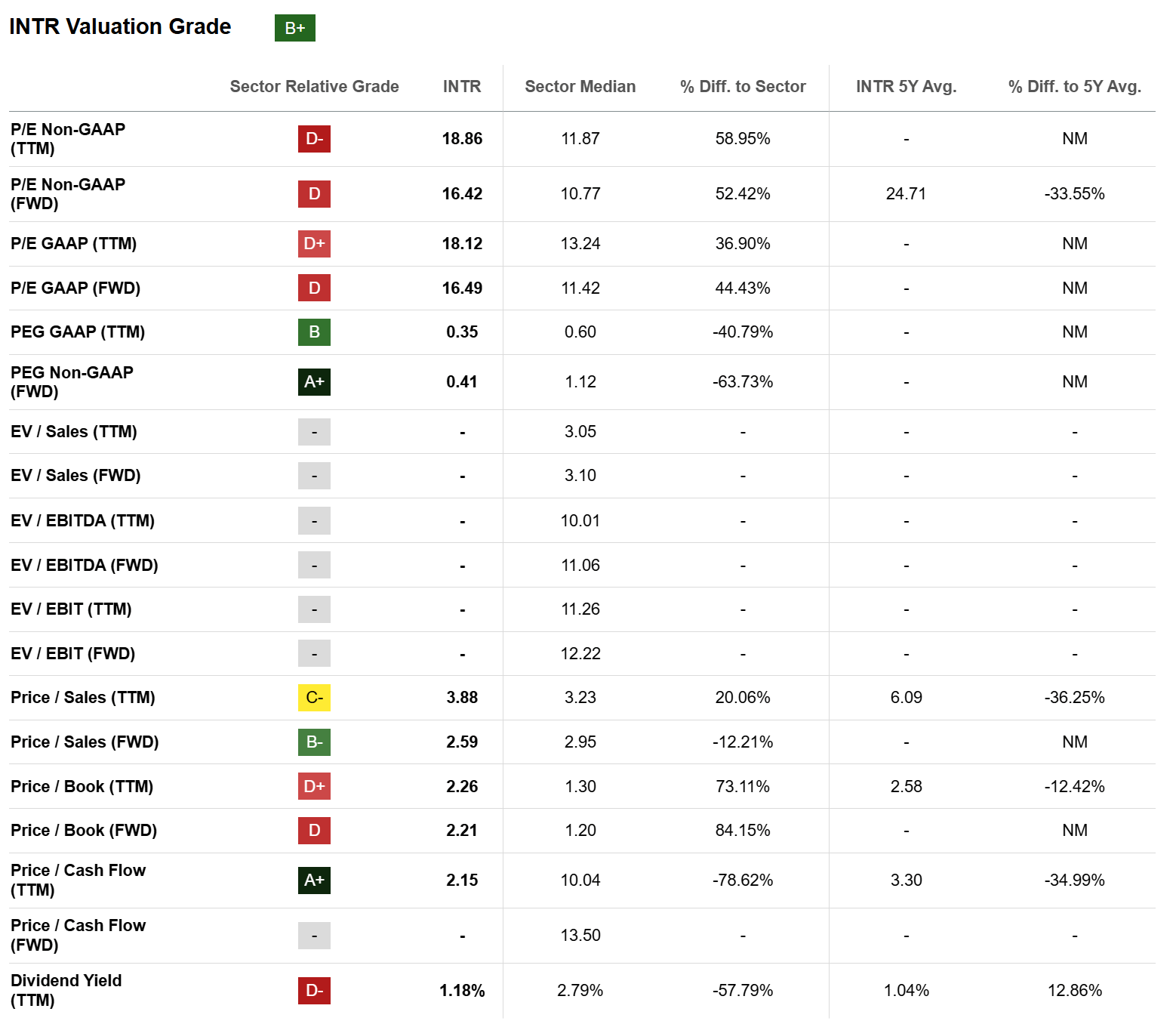

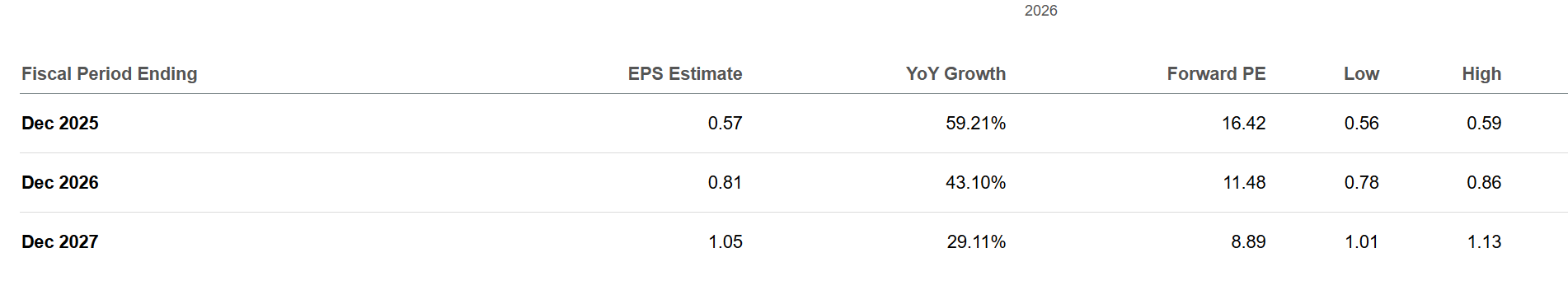

Now, the valuation you might think the P/E is out of whack and compared to a traditional low growth bank, it is. But it is a digital power house, and in reality is kind of cheap fr the growth and price to cash flow. The PEG ratio is 0.41 is notable as can be. Stands out. Other growth metrics are eye-popping.

Solid grades for revenue and EPS and that EPS growth is expected to continue for years. So it is cheap for the growth.

What about some of the risks here? The most prominent risk for international investors is foreign exchange volatility. Since Inter & Co’s primary operations are still in Brazil, despite its massive international growth, its revenue and assets are denominated in Brazilian Reals, the BRL, while its stock trades in US Dollars. Significant devaluations of the Real against the Dollar can erode the value of the investment even if the company is performing well locally. Furthermore, Brazil’s economy is historically sensitive to political instability and fiscal policy shifts, which can lead to high inflation and extreme fluctuations in the Selic rate (the benchmark interest rate). While high rates can increase net interest income, they also raise the cost of funding and increase the likelihood of borrower defaults.

As Inter & Co aggressively expands its loan book, it faces substantial credit risk. A large portion of its growth comes from credit cards and personal loans, which are more susceptible to delinquency during economic downturns. Specifically, the unsecured lending side of things. While the company is shifting heavily toward secured loans (like payroll and mortgages), a significant part of its portfolio remains unsecured. In Brazil, credit card delinquency rates are historically high compared to global averages, and while we hate to keep harping on the Brazil aspect it is still notable. Provisioning costs are also notable. Rapid expansion into new products, such as private payroll loans, requires heavy upfront provisioning which can weigh on short-term net income regardless of the actual loan performance.

Then obviously international regulation risk hits any financial doing global business. Risks from regulatory changes that could cap interest rates on credit cards or overdrafts, rules with ‘Open Banking’ and payment systems can reduce fee income from transfers. Rule changes have also made it easier for customers can switch banks. The competitive environment is also intense, with Inter fighting for market share against both established banks and other aggressive fintech giants. Finally, risks associated with cybersecurity persist, and heavy expenses on preventing hacks and attacks will continue.

One of the questions we get a lot is what do we do at BAD BEAT Investing? What we do at the service is completely different than what we do on the public site for the most part. On occasion, we will highlight publicly a conviction idea, such as Micron (MU) as a strong buy when it was at about $230 a few months ago. At BAD BEAT, we provide high level research into names we have high conviction in, with strong risk-reward. While stop losses are ocassionally taken, the win rate (the number of trades hitting target exits to the number that get stopped is over 8 to 1 historically. And, for those interested, we are offering access at a 75% discount on the one-month trial for February. We provide a clear google sheet tracker that documents all entries, exits, returns etc. We also list our portfolio of house positions (positions we leave a portion of the profit in for long-term investment and compounding to build wealth). We also teach options, trading approaches, provide Street insider insights into market action, and a weekly game plan each weekend on what to watch.

Overall, we have a stock with a strong chart, a clear growth path, and an attractive valuation. The 60-30-30 plan is the big attraction here. It is their five-year roadmap introduced at their 2023 Investor Day. It serves as a commitment to shareholders that the company can transition from a high-growth, cash-burning fintech into a high-scale, highly profitable financial powerhouse. And the results have shown barely halfway in that it is working well. We think they are well on their way to the client target of 60 million, while the efficiency ratio continues to improve. The 30% return on equity is really ambitious. The best banks in the world are high-teens or overy low 20%. But to move from negative on this measure, to now positive, and increasing, suggests the stock has a lot of room to run following the fundamental improvement.